How Many Computers Can Quickbooks For Mac

QuickBooks for Mac is an accounting software specifically designed for business owners who use Mac computers. You can purchase QuickBooks for Mac for a one-time fee of $299.99 and use it to track of all your business finances.

QuickBooks for Mac is packed with features to help you organize your income and expenses. You can pay bills, invoice customers, track inventory, and track and pay 1099 contractors. You will also have access to detailed reports to make tax time a breeze. Get your business up and running on QuickBooks for Mac 2019 and save up to 40% for a limited time.

Online shopping from a great selection at Software Store. TeachUcomp, Inc. Course used for learning QuickBooks Desktop Pro 2019 DELUXE Training Tutorial- Video Lessons, PDF Instruction Manual, Quick Reference Guide, Testing, Certificate of Completion.

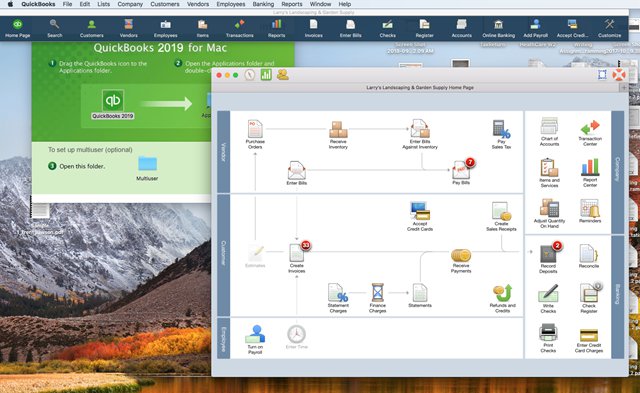

How QuickBooks for Mac Works

QuickBooks for Mac is very similar to QuickBooks for PC in terms of how it works. After you purchase the software, it must be installed on your computer before you can use it. Once installed, you will need to provide some details about your business and have a few documents handy to get your business set up properly.

Listed below is a checklist of what you will need to set up a new company in QuickBooks for Mac:

|

|

Once you have completed the setup process, you are ready to track all your business finances in QuickBooks for Mac. You can download the QuickBooks Set Up Checklist to your computer.

Listed below are six day-to-day tasks you can complete in QuickBooks for Mac.

1. Track Sales & Income

You can record a sale from services or products in QuickBooks for Mac by creating a sales receipt or an invoice. If your customer pays you at the time that you provide the goods or service, create a sales receipt. However, if your customer prefers to be billed, you will create an invoice instead. Both sales forms can be emailed to your customer directly from QuickBooks so that you don’t have to print and mail them.

2. Track Bills & Expenses

Similar to QuickBooks Online, there are several ways to keep track of your bills and expenses in QuickBooks for Mac. You can download your transactions, enter bills manually, or import expenses from a spreadsheet.

Listed below are three common ways to stay on top of your expenses:

- Connect your bank and credit card accounts so that transactions automatically download into QuickBooks for Mac

- Manually enter all vendor bills and print checks directly from QuickBooks for Mac

- Import billing details from an Excel spreadsheet into QuickBooks for Mac

3. Track Inventory

QuickBooks for Mac will keep track of all product purchases and sales. This means that you can create a purchase order and send it to your supplier. When the goods arrive, you can mark them as received against the original purchase order.

As you sell items in inventory, QuickBooks will automatically reduce your quantity on hand. In addition, when you reach the minimum order quantity, you will receive an alert to remind you to place an order. Several detailed reports are available for you to run and gain insight into your purchases and sales by product, customer, and many other options.

4. Run Payroll

If you have employees, you can turn on the Intuit Payroll services from within QuickBooks for Mac. Payroll processing in QuickBooks for Mac starts at $29 per month and includes:

- Payroll check calculations

- Pay via check or direct deposit

- W-2s for employees

- Payroll tax forms and filing

5. Accept Online Payments

Similar to QuickBooks Online, you can accept online payments from your customers with QuickBooks for Mac. When you enable the Intuit Payments feature, it will put a “Pay Now” button on all invoices that you email to customers. They can pay the invoice right away using a debit card or credit card or enter their bank account information. Turning this feature on requires you to click a button or two. There are two plans to choose from when you sign up for Intuit Payments.

Below is a summary of the Intuit Payment pricing plans for QuickBooks for Mac:

Come face to face with some of the most threatening scenarios that will result in a different experience each time you play. Experience the terrifying encounters of the harsh Ocean and all its vicious marine wildlife. Come face to face with some of the most threatening scenarios that will result in a different experience each time you play. Experience the terrifying encounters of the harsh Ocean and all its vicious marine wildlife. Take the role of a plane crash survivor stranded somewhere in the Pacific Ocean.

| Payment Type | ||

|---|---|---|

| Bank Transfer (ACH) | ||

| Card - Swiped | ||

| Card - Invoiced | ||

| Card - Keyed |

6. Run Key Reports to Gain Insights into Your Business

Similar to QuickBooks Online, QuickBooks for Mac has several detailed reports that you can run to gain key insights into how your business is doing. The reports available include but are not limited to profit and loss, balance sheet and statement of cash flows. Check out our guide on SMB Bookkeeping, Accounting, and Taxes to learn more about these reports.

Who QuickBooks for Mac Is Right For

The QuickBooks for Mac software is only compatible for computers with an iOS operating system. If you use a PC, then QuickBooks for Mac will not work for you. Head over to the Alternatives for QuickBooks for Mac section of this article to learn more about your options.

Business owners that use a Mac computer should use QuickBooks for Mac if they:

- Don’t need access to data while away from the office

- Don’t have more than three users that need simultaneous access

- Don’t need to connect their bank card or credit card accounts to QuickBooks for Mac

Unlike QuickBooks Online, QuickBooks for Mac is only accessible on the computer that you installed the software on. This means that you won’t be able to access the data while away from the office unless you sign up with a hosting service like Right Networks.

You can have a maximum of three users in your QuickBooks file at the same time, and you cannot connect your bank cards and credit card accounts to QuickBooks for Mac. This means that you will need to manually enter this data or import it from an Excel spreadsheet.

QuickBooks for Mac Costs

QuickBooks for Mac starts at a one-time fee of $299.95. As previously discussed, you can add payroll processing and payment services at any time for an additional fee. Unlimited tech support is included for the first 30 days. At the end of the 30 days, you will need to purchase a service plan to contact tech support for assistance.

QuickBooks for Mac Features

When it comes to features included, QuickBooks for Mac is packed with features that go well beyond the basics of tracking income and expenses for your business. In addition to tracking accounts payable, accounts receivable (A/R), inventory, payroll, accepting online payments, and having the ability to run detailed reports, we have included a list of additional features included.

Below are 12 additional features you will find in QuickBooks for Mac, including the new 2019 features.

1. Batch Invoicing

With batch invoicing, you can save a lot of time by completing one invoice and sending it to a group of customers. This is ideal if you sell the same products and/or services to a number of customers at the same time.

Example: Let’s say you are a real estate investor, and you own several buildings with tenants that pay monthly rent. If we assume that you have ten tenants that pay $1,000 a month for rent, you can create one invoice and send it to all 10 tenants at the same time.

2. Customized Chart of Accounts

Like most QuickBooks products, when you go through the initial company setup, QuickBooks will create a chart of accounts for you based on the industry that you selected. You can customize this list further by adding additional accounts that you need to track your income and expenses. You can remove accounts that you don’t need.

Example: Let’s say that you are a web designer, and you want to keep track of your initial consultation fee separate from the income you earn for the actual web design work. You can create an account called “Initial Design Consultation Fee” to keep track of this separately.

3. Custom Products & Services List

To keep track of all income earned from the products and services that you sell, you need to add these items to your products and services list in QuickBooks for Mac.

B&o for macbook. “Back in January 2018, Bang & Olufsen announced that Apple AirPlay 2, Apple’s next generation wireless multi-room audio system, will be integrated into 10 Bang & Olufsen and B&O PLAY multiroom speakers,” Mark Sparrow reports for Forbes.“Petros Belimpasakis, Director and Head of Sound Category and Platform in Bang & Olufsen said: ‘AirPlay 2 is a seamless way to enjoy music from your favourite Apple device and is a natural extension of how people live with music. We are proud to be among the first companies to bring forward the experience of multiroom control in your Apple device and to deliver on the promise that our multiroom speakers connect with all streaming technologies,'” Sparrow reports. “With AirPlay 2, Bang & Olufsen and B&O PLAY speakers also work alongside Apple’s HomePod, so B&O users can use Siri to play music around the house.”Sparrow reports, “AirPlay 2 will be available on both new and older Bang & Olufsen and B&O PLAY speakers as an over-the-air update during August and September 2018.”Read more in the full article.MacDailyNews Take: B&O users, rejoice (in August and September)!

Example: Using our example above for Initial Design Consultation Fee, you can set this up as an item on your products and services list. This makes it easy to bill customers because you can select it from the drop-down list when you create your invoices.

4. Track Multiple Locations & Departments

If you need to track income and expenses for multiple locations or departments, you can do this in QuickBooks for Mac. The feature that you will turn on is called class tracking. Once you set up all your locations and/or departments, you can tag all income and expenses with the appropriate “class.”

Example: Going back to our real estate investor that owns several buildings. The owner would like to track each building as a separate class so that he can run profit and loss reports to see how profitable each location is. He would set up each building as a class and then going forward tag all income and expenses to the appropriate class like building.

5. Budgeting & Forecasting

QuickBooks for Mac includes a robust budgeting and forecasting tool that allows you to create annual budgets for all income and expenses. In addition, you could create a budget for a specific customer or job and then run budget vs. actual reports periodically to check your progress.

Budgets can be created from scratch or QuickBooks will populate the previous year’s actuals as a starting point, and then you can make any necessary adjustments for the current budget year.

6. 1099 Tracking

If you hire independent contractors, you can track payments made in QuickBooks for Mac easily. At the end of the year, you can also generate the information that you need to provide the 1099 forms and reports that must be provided to the contractor and your local tax authority.

7. Multi-user Access

QuickBooks for Mac allows you to give up to three users access to your QuickBooks data. As the business owner, you will be the admin user, and you will be able to purchase up to two additional licenses to give access to your bookkeeper, certified public accountant, or tax professional. Keep in mind that the data is only accessible from the computer or network server where you installed the software.

8. iCloud Document Sharing

iCloud document sharing is a new feature that you will find in the new QuickBooks for Mac 2019 version. This feature allows you to move QuickBooks files from one Mac to another. You can share files between multiple Macs connected through iCloud.

9. Reconciliation Discrepancy Report

The reconciliation discrepancy report is also a new feature that you will find in the new QuickBooks for Mac 2019 version. In the past, this feature was only available in QuickBooks Desktop for PC and QuickBooks Online Accountant. It allows you to troubleshoot any issues that you have with reconciling your bank and credit card accounts each month.

An example of the reconciliation discrepancy report is below:

Reconciliation Discrepancy report from QuickBooks for Mac.

10. Email Tracking for Customers and Vendors

QuickBooks allows you to send emails to customers with estimates, invoices, and other documents attached. In addition, you can also email purchase orders and other documents to vendor suppliers. This new feature that has been added to QuickBooks for Mac 2019 tracks all emails sent to vendors and customers so that you can review this data any time.

11. Past Due Stamp on Invoices

With the 2019 QuickBooks for Mac version, customer invoices that are delinquent will now have a “Past Due” stamp on them in QuickBooks so that you can see easily which invoices are outstanding. If you email the invoice to the customer after the due date, he or she will also see the “Past Due” stamp, which should prompt your customer to make a payment. See an example of this below:

Past Due stamp on delinquent Invoices in QuickBooks for Mac.

12. Square Transactions Import

The last new feature that was added to QuickBooks for Mac 2019 is the ability to import your sales data from Square into QuickBooks for Mac. This will save you a ton of time because you won’t have to enter the data manually any longer. See an example of how this works below:

Pros & Cons of QuickBooks for Mac

Like with most software products there are pros and cons to using QuickBooks for Mac. While it is user-friendly, packed with features, and easy to find help when you need it; it is not accessible easily and is limited when it comes to QuickBooks Online support and the number of users to whom you can give access.

Pros of QuickBooks for Mac

There are several positives to using QuickBooks for Mac. Like the PC version, it has a user-friendly interface, it includes several robust features at an affordable price, and it’s easy to find an expert if you need help.

Below are three pros of using QuickBooks for Mac:

- User-friendly: Like most QuickBooks products, QuickBooks for Mac is easy to set up and navigate if you don’t have a bookkeeping or accounting background

- More features for cost: QuickBooks for Mac includes many features at an affordable one time cost of $299.99; A/R, accounts payable (A/P), inventory tracking, and 1099 reporting are some of the features included in QuickBooks for Mac

- Get help when you need it: If you need help setting up your business or you have questions, you can find a bookkeeper or accountant who is familiar with QuickBooks for Mac; be sure to check out our How to Find QuickBooks ProAdvisors guide to learn how to find a QuickBooks for Mac expert in your local area

Cons of QuickBooks for Mac

Most of the drawbacks of QuickBooks for Mac are centered on the fact that it is a desktop product that requires you to install software. As a result, there are limitations when it comes to accessibility, QuickBooks Online support and number of users.

Below are three negatives of using QuickBooks for Mac:

- No mobile access to data: Unlike QuickBooks Online which allows you to access your data from any computer with an internet connection, QuickBooks for Mac can only be accessed from the computer where the software was installed; as discussed previously, you can sign up for a hosting plan to access your data away from the office

- Limited tech support: When you purchase QuickBooks for Mac, it comes with unlimited tech support for the first 30 days; afterward, you must purchase a support plan to get help or hire a QuickBooks expert

- Maximum of three user licenses: QuickBooks for Mac comes with one user license’ you can purchase up to two additional licenses if you need to give other users access to your data

Alternatives to QuickBooks for Mac

QuickBooks Online for Mac is an ideal alternative to QuickBooks for Mac Desktop. QuickBooks Online is cloud-based accounting software that can be used on any desktop computer, laptop, tablet, or cellphone. Unlike QuickBooks for Mac Desktop, there is no software to install. You need a device that can connect to the internet and you can access your data easily by logging in with a secure ID and password.

There is a glance at the three QuickBooks Online for Mac pricing plans:

- QuickBooks Online Simple Start: Costs $20 per month; ideal for startup businesses; save up to 50% here

- QuickBooks Online Essentials: Costs $35 per month; best for small to medium-sized businesses that sell services only; save up to 50% here

- QuickBooks Online Plus: Costs $60 per month; best for any business that sells products or services; save up to 50% here

Below is a summarized feature comparison chart of QuickBooks for Mac vs. QuickBooks Online pricing plans.

QuickBooks for Mac vs. QuickBooks Online for Mac Feature Comparison at a Glance

QuickBooks Online Simple Start

QuickBooks Online Simple Start is ideal for startups that pay their bills with a debit card, credit card, or through an automated clearing house (ACH). This plan is the most economical out of the three plans at $20 per month. However, it is limited when it comes to features included. While you can manage A/R, connect your bank card or credit card accounts and give access to one user and two accountants, QuickBooks Online Simple Start does not include the following features:

- Ability to manage A/P

- Ability to track inventory

- Track payments to contractors & prepare 1099s

- Create & manage budgets

QuickBooks Online Essentials

QuickBooks Online Essentials is right for small to medium-sized businesses that sell services only. This plan is the mid-tier plan and will cost $35 per month. In addition to the features included in the Simple Start plan, it includes the following features:

- Ability to manage A/P

- Ability to give access to three users plus two accountants vs. one user and two accountants in the Simple Start plan

QuickBooks Online Plus

QuickBooks Online Plus is ideal for small to medium-sized businesses that sell products and services. This plan is $60 per month, three times the Simple Start plan ($20 per month) and $25 per month more than the Essentials plan. However, you do get several additional features for the hefty price tag:

- Ability to give access to five users and two accountants for a total of seven users vs. five with the Essentials plan and three in Simple Start

- Able to track inventory

- Track payments and prepare 1099s for independent contractors

- Create & manage budgets

QuickBooks Online Plus is the plan that comes closest to including all the features that you will find in QuickBooks for Mac Desktop. The primary difference between the two plans is all QuickBooks Online plans included unlimited QuickBooks Online support vs. free tech support for the first 30 days with QuickBooks Mac.

For support beyond 30 days, you will need to purchase a support plan. In addition, QuickBooks Online Plus includes up to seven users, and QuickBooks Mac comes with one user license, and you can purchase up to two additional licenses.

If you are a current QuickBooks for small business Mac user who is considering switching to QuickBooks Online, check out our guide on converting from QuickBooks Desktop to QuickBooks Online.

QuickBooks for Mac Reviews

QuickBooks for Mac users who gave a positive review like the robust features and the easy to use interface. However, users who gave a negative review said that QuickBooks for Mac doesn’t quite have all the bells and whistles that QuickBooks Desktop for the PC has. Be sure to check out our QuickBooks for Mac reviews page for more information.

QuickBooks for Mac Frequently Asked Questions (FAQs)

Listed below are the most frequently asked questions about QuickBooks for Mac.

Is there a Mac Version of QuickBooks?

There is a Mac version of QuickBooks, and the latest edition is QuickBooks for Mac 2019. You can purchase QuickBooks for Mac for $299.99 and install the software on your Mac computer. Similar to the PC version of QuickBooks, you can track all your business income and expenses in QuickBooks for Mac.

Is QuickBooks for Mac Discontinued?

Last year, Intuit announced that it was discontinuing QuickBooks for Mac and would support the 2016 version through May 31, 2019. However, due to feedback from several QuickBooks customers who use QuickBooks for Mac, Intuit renewed its commitment to these customers by releasing QuickBooks for Mac 2019.

What’s the Difference Between QuickBooks for Mac and QuickBooks Online?

There are several differences between QuickBooks for Mac and QuickBooks Online. QuickBooks for Mac was designed for Mac users and must be installed on a Mac computer whereas QuickBooks Online is a cloud accounting software that doesn’t require installation and can be used on a PC, Mac or any mobile device with an internet connection.

Check out our QuickBooks comparison chart for a detailed breakdown of the differences between QuickBooks for Mac and QuickBooks Online.

What’s the Difference Between QuickBooks for Mac and QuickBooks for PC?

There are several differences between QuickBooks for Mac and QuickBooks for PC. QuickBooks for Mac was designed specifically for Mac computers and QuickBooks for PC was designed for the PC. Both products have a starting price of $299.99 and include many of the same features such as the following:

- Track and pay bills

- Create and send invoices

- Track inventory

- Track and pay 1099 contractors

- Detailed reports such as profit and loss, balance sheet, and cash flow statement

The Bottom Line

Now that you know what QuickBooks for Mac is and how it works, it’s time for you to make a decision. If you need access to your data 24/7/365, choose QuickBooks Online for Mac. However, if you don’t need mobile access to your data, and you want an affordable way to manage your income and expenses, choose QuickBooks for Mac.

QuickBooks for Mac allows you to keep track of every financial aspect of your business. Create invoices or sales receipts to track income and write checks to pay your bills. With a few clicks, you can review sales and analyze how profitable your business is. QuickBooks offers a 60-day money back guarantee, so you’ve got nothing to lose. Download QuickBooks for Mac 2019 and get your business up and running in no time.

Still traveling to your clients’ computers to access QuickBooks? Cut down on wasted time and remote access QuickBooks on your clients’ computers instead!

Tax season is already bad enough, and it’s even worse when you have multiple clients spread out across several locations. There’s nothing more draining than having a mountain of work to get through and wasting precious hours each week driving to your clients’ computers.

For tax preparers whose clients use the desktop version of QuickBooks, this nightmare is a reality.

After all, you’re likely one of the 90% of CPAs who say they average at least 50 hours of work per week during busy season (hopefully you’re not among the 29% who say they work 70 hours or more per week).

Instead, imagine that all of your clients’ QuickBooks and other important data are accessible to you via your own computer, tablet, or even smartphone device. No matter where in the world you are or what time it is, you can remote access QuickBooks on any of your clients’ computers in seconds.

That’s why thousands of tax preparers and accountants have turned to remote access software.

The Benefits of Remote Accessing QuickBooks

- You will cut down on wasted time spent traveling to clients

- You can work from the comfort of your own home

- You can use a mobile device in addition to a computer to access QuickBooks remotely

- You can stay productive even while on the go

- You can access your clients’ computers outside of regular work hours

All of this means that you can reduce the amount of hours you work each week, eliminate stress, and still get all of your work done by taking advantage of remote access software.

With that said, not all remote access tools are equal, especially when you want to use it to access QuickBooks. So make sure you get the tool that gives you the freedom and accessibility you desire, while also being reliable and secure.

For those reasons, Splashtop Business Access is the best tool for tax pros who want to access QuickBooks. The plug and play nature of Splashtop means you can try it for free right now and try out remote access for yourself in minutes.

(no credit card or commitment required to get started)

How to Remote Access QuickBooks

Once you get started with Splashtop Business Access, you’ll have unlimited remote access to your clients’ Windows and Mac computers, from any of your Windows, Mac, iOS, Android, and Chromebook devices.

Using any device, you’ll be able to access your client’s QuickBooks in seconds:

- Open the Splashtop Business app on your device.

- Look through your list of computers until you find the one you want to access.

- Click to start the remote session – then the remote computer screen will open on your device. You will now be able to remote control the computer in real time.

- Open QuickBooks on the remote computer.

That’s it! You can literally connect in seconds from ANY of your devices at any time, and from anywhere in the world. That includes remote access to QuickBooks from your iPhone, iPad, or Android device.

What You Can Do While Remote Accessing QuickBooks

Once remoted into QuickBooks, you can complete regular tasks with ease.

- Control QuickBooks and other apps as if you were sitting in front of the remote computer

- Remotely print checks, receipts, 1099 forms, and other documents from the remote computer to your local printer

- Transfer important files from your clients’ computers to yours so you can save important information locally

- Train your clients on how to use certain apps or best practices easily as they’ll see the same screen as you in real time while you talk them through it

- … and more!

Splashtop is the best remote access software for tax preparers and accountants (and 20 million other users around the world!) because it helps them save time and still be productive thanks to remote access.

Not to mention, Splashtop remote access is completely secure. You and your clients can know that between encrypted connections, device authentication, two-step verification, multiple 2nd-level password options, and other security features, your data is secure.

Ready to try it yourself? Get started now with a free trial so you can stop wasting time traveling to clients all day. No credit card or commitment required.